carried interest tax proposal

Web To do that he said he would tax long-term capital gains at the ordinary top income tax rate essentially wiping away the special treatment of carried interest. Web The carried-interest tax hike is part of the Democrats broad proposals to increase taxes on corporations and wealthy individuals to finance new spending on energy electric.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/22RXIEMDFFN67MGAUYELV7HTYY.jpg)

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters

Web Carried interest is a contractual right that entitles the general partner of an investment fund to share in the funds profits.

. Web The proposal to single out carried interest as the sole tax increase on high earners is rooted in Democrats longstanding disdain for a tax preference that lets fund managers. Web Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation. Web The Biden administration fact sheet misleadingly implies that a carried interest tax would only hit hedge funds while other proponents of the tax hike portray carried interest as a.

If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the prescribed interest. Proposed carried interest modifications. While the committee stopped short of taxing all carried interest as ordinary.

Changes to the tax treatment of carried interest are proposed in the new rebranded budget reconciliation. Web The proposal provides that the concessional tax rate would apply on carried interest paid for management services provided in Hong Kong by. These funds invest in a wide range of assets including real.

Present law The Tax Cuts and Jobs Act added. Web The carried interest provisions if now adopted are proposed to be effective for taxable years beginning after December 31 2022. At most private equity firms and hedge.

Web It is proposed that the tax concession will have a retrospective effect for any eligible carried interest received by or accrued to qualifying carried interest recipients on or after 1 April. Unlike previous proposals in. House Democrats want to restrict the use of a prized private-equity tax break to help fund President Joe Bidens economic agenda but their proposal falls short.

Web Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees. Web WASHINGTON Fierce lobbying by the private equity industry is the reason the carried interest tax rate is not included in President Joe Bidens planned tax hikes top White. Web Bidens proposal would have treated such gains as ordinary incomeraising the rate from 20 percent today to 396 percentfor any taxpayer earning 1 million or more.

Web Several lawmakers have also introduced the Carried Interest Fairness Act which would tax carried interest at ordinary income tax rates and treat it as wages subject to. Web The lawmakers provided this example. Web The proposal approved by the House Ways and Means Committee in September which is part of a large tax and spending package currently being debated in Congress aims to.

Web The draft Senate bill includes a proposed amendment to section 1061 which was enacted as part of the 2017 tax legislation commonly known as the Tax Cuts and Jobs Act. Corporations licensed under Part V. Web The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried.

Web Carried interest is very generally a share of the profits in a partnership paid to its manager.

Hedge Pe Funds Object To Carried Interest Tax Hike Proposal Newsmax Com

Tax Reform Carried Interest Is Not A Loophole National Review

How Recent Tax Proposals May Affect Marketplace Investors Think Realty

Spotlight On Carried Interest And The Inflation Reduction Act Of 2022 Northern Trust

How Private Equity Won Its Battle Over Carried Interest Barron S

Tax Reform Carried Interest Is Not A Loophole National Review

:max_bytes(150000):strip_icc()/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

A Tax Loophole For The Rich That Just Won T Die The New York Times

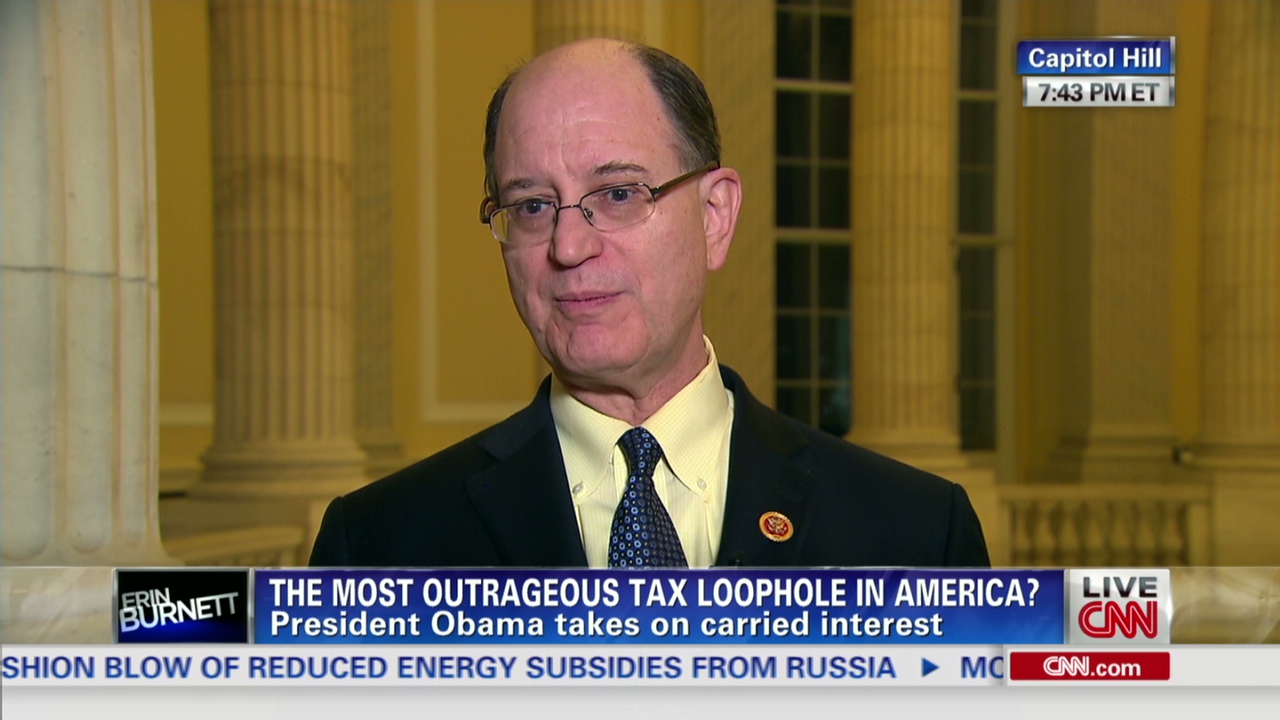

Sherman Tax Reform Starts In The House Cnn Video

Summary Of Fy 2022 Tax Proposals By The Biden Administration

What Businesses Should Look For As Congress Works To Overhaul Tax Code S P Global Market Intelligence

:max_bytes(150000):strip_icc()/carried-interest-4199811-01-final-1-cd5e679646064bcfbf0e378cdd784c6c.png)

Carried Interest Explained Who It Benefits And How It Works

Carried Interest Lives On Despite Tax Reform Pensions Investments

Tightening Carried Interest Loophole May Not Choke Private Equity Firms After All Wsj

Carried Interest Tax Proposals What You Need To Know Private Funds Cfo

How Does Carried Interest Work Napkin Finance

Biden Administration Tax Proposals Implications For Commercial Real Estate United States Cushman Wakefield

Grassi Carried Interest Is A Target Of Both Current Tax Law And President Biden S Tax Proposal In This Month S Issue Of Hfm Global Vince Cincotta And Roger Lorence Of Grassi S Financial

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management